ESCROW SERVICES

ESCROW SERVICES

Beke’s escrow teams have the expertise and experience of managing complex escrow transactions to ensure your capital is held securely and payments are delivered efficiently.

Your independent, trusted escrow agent

Whether it is for a bond or loan insurance or to support an acquisition, our institutional and corporate clients rely on us to provide an independent, trusted and fast turnaround for their escrow needs.

Beke Chambers LL.P has a dedicated escrow team that is well versed in providing escrow services for cash and physical assets across complex, multi-jurisdictional scenarios.

We will act as an independent escrow agent to hold your assets securely in escrow and distribute them according to your instructions or the terms of your transaction agreement.

By leveraging our dedicated KYC team and strong relationships to open bank accounts fast and run KYC procedures quickly, we are highly responsive to your needs and ensure that your cash and assets are held securely and released promptly.

ESCROW AGENT

As escrow agent, we will look after specified assets until conditions are met between parties.

Cash and non-cash escrow

We will assist by providing a designated account or system to hold items including cash and/or documents in a neutral capacity until the legal issue or financial transaction has been completed.

Valuables held in escrow can include real estate, stocks, securities, documents such as bills of loading in shipping.

Opening bank accounts

We open bank accounts or hold cash in a money market fund for a specific purpose as outlined in the escrow agreement.

Amending documentation where necessary

We will incorporate specific new conditions to the contract as required.

Releasing assets

We will release assets upon the satisfaction of the stated conditions in the governance documentation.

ANTI-MONEY LAUNDERING (AML) COMPLIANCE SERVICES

We help ensure that your business is fully protected and in line with the latest AML compliance and regulations.

We put client protection at the heart of what we do

Many firms want to ensure protection against the risks of financial crime such as money laundering but are faced with resourcing and cost issues.

We offer clients an outsourced AML compliance services function which allows firms to manage their regulatory risk and operating overheads.

By outsourcing your AML obligations to our full-service compliance team, you can operate more confidently as our business grows.

We also offer advisory and audit services on AML KYC issues to clients.

How we help

Cover every aspect of AML compliance

We offer an outsourced AML compliance solution which handles customer onboarding and periodic reviews, PEPs & sanctions screening, transaction monitoring, AML reporting, and general financial crime advice.

Understand your risk exposure

We carry out an independent audit to examine and evaluate a firm’s policies, controls and procedures, including a review of a firm’s KYC onboarding records.

Improve internal awareness of financial crime

We understand that a fully staffed and resourced compliance function may be beyond some clients; therefore, we work with your existing teams to improve their understanding of the key risks involved.

AML compliance services

MLRO provision

We will provide a Money Laundering Reporting Officer (MLRO) where required.

Transaction monitoring

We conduct transaction monitoring and SPT reporting when necessary and report to the MLRO and board of the funds.

Outsourced AML function

We undertake outsourced AML checks, including assistance with customer due diligence (CDD) reviews and CDD onboarding.

Independent AML audit

We provide independent audit and evaluation against local legislation and regulations, including examination of effectiveness of policies, procedures, by the client or its service providers; recommend and implement action plans and monitor compliance (including registration for Crypto firms under AML regulations.)

AML systems and control implementation

We identify and assess the risks a firm faces in respect of financial crime, assist in the implementation of policies, controls, and procedures to mitigate and manage effectively the risks identified.

AML compliance framework

We conduct AML/KYC on fund investors and maintain all investor documentation. We conduct transaction monitoring and SPT reporting when necessary and report to the MLRO and board of the funds.

WHAT IS AN ESCROW ACCOUNT

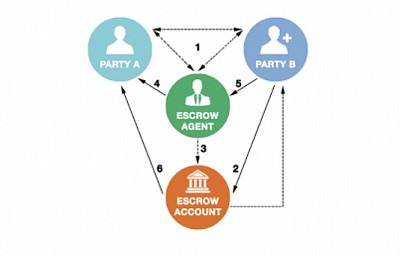

An escrow account is a financial arrangement whereby a licensed third party, which is elected by the transacting parties as an entrusted independent third party, assumes the role of an escrow agent. The escrow agent holds and regulates payment of the funds required for contractual parties involved in a specific transaction.

An escrow account is a financial arrangement where a third party holds and manages funds or assets on behalf of two parties involved in a transaction. The purpose of an escrow account is to provide security and ensure that both parties fulfil their obligations before the funds or assets are released.

Escrow accounts can also be used in other situations, such as for large purchases, business transactions, or even online transactions. They provide a level of protection and assurance for both parties involved, as the funds or assets are held by a neutral third party who ensures that the agreed-upon conditions are met before releasing the funds.

The specific terms and conditions of an escrow account are typically outlined in a legal agreement or contract, specifying the responsibilities of each party and the circumstances under which the funds or assets will be released. The escrow agent, usually a trusted financial institution or an attorney, oversees the account and ensures that the transaction progresses according to the agreed-upon terms.

Why you should appoint an escrow agent in a business transaction?

An escrow agent may serve as an added level of protection within a business transaction, which level of protection is set to mitigate the commercial risks for all parties to a transaction. Mitigation of risk is achieved by the escrow agent ensuring that conditions precedent to a transaction are fulfilled by all parties to the said transaction. Such assurance shall be provided prior to a secure escrow payment used to exchange of funds and goods and/or services.

Furthermore, the independent third party (the escrow agency) provides an extra level of security for all parties by receiving and retaining the funds relating to the transaction in an escrow account, which funds are only released once a confirmation is given that all terms to an agreement are met. The escrow agent may itself be the party verifying that all conditions have been met, alternatively, in certain industry-specific transactions, whereby completion is subject to confirmations from technical experts within the field in question, the parties may elect independent experts (such as engineers) to verify the order/service (subject to the transaction) and its conditions as may be applicable within the context of the transaction

When to opt for an escrow account?

It is safe to state that escrows are most commonly sought for in transactions of substantial value, and/or in cases where a number of obligations need to be fulfilled before the secure release of payment. The added level of security which an escrow service provides is deemed invaluable to parties who are desirous to transact with other business partners having different practices or cultural backgrounds to theirs.

How is an escrow account set up?

An escrow account is set up by virtue of an escrow agreement. The escrow agreement sets out the key features and terms for the operation of an escrow account. Primarily, an escrow agreement shall highlight and set out the context for which an escrow is being set-up, that is, why the parties in question are requesting the utilization of an escrow account. This context shall be backed up by the mechanisms of the escrow account. The mechanisms of an escrow account specify the exact manner how the account shall operate. This gives the parameters to all parties to a transaction. Furthermore, the escrow agreement shall highlight the responsibilities and duties of each and every party.